Good Advice For Selecting RSI Divergence Trading

Wiki Article

Good Info For Selecting An RSI Divergence Strategy

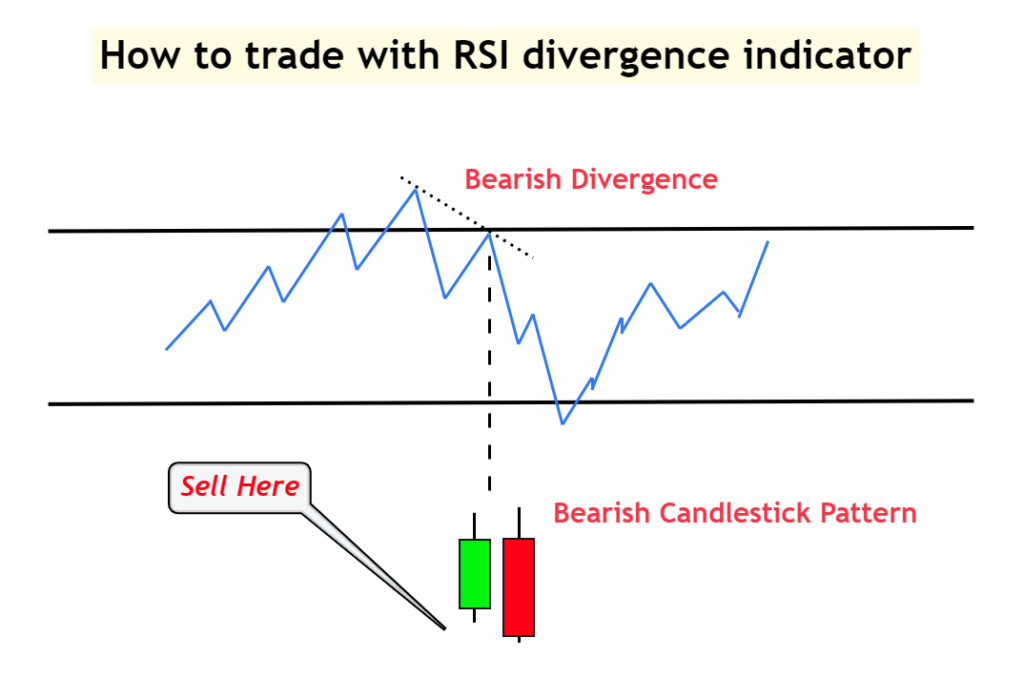

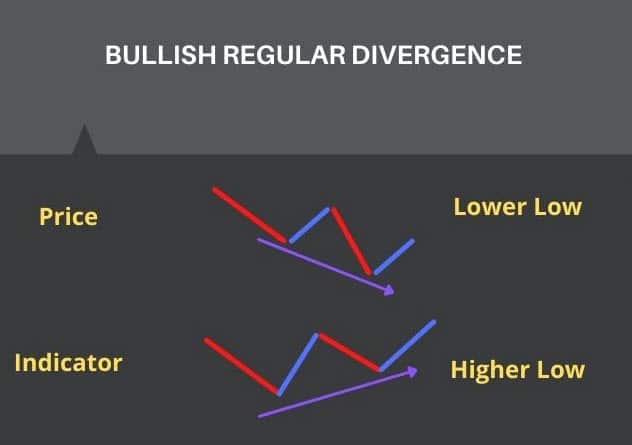

Let's begin by asking the obvious query and explore what is RSI Divergence is and what trading signals we can derive from it. When the price action of your chart and the RSI signal are out of the same synchronization, a divergence is likely to take place. Which mean, in a Downtrend market, Price makes a Lower low. However, the RSI indicator has higher lows. A divergence is the time when an indicator does not agree with the price movement. This situation should be a warning sign that you need to be attentive to the market. The chart shows that both the bullish RSI diversgence as well as bearish RSI diversion are clearly visible. In reality the price action changed after the two RSI divergence signals. Let's get to the topic that is exciting. Check out the best divergence trading forex for site tips including forex trading, crypto trading, crypto trading backtesting, trading divergences, crypto backtesting, forex backtesting, forex backtesting software free, automated trading software, crypto trading bot, trading platform and more.

How Do You Analyze The Rsi Divergence?

We employ the RSI indicator for identifying trend reversals, It is crucial to determine the right trend reversal, in order to do this, we need to have a trending market, then we utilize RSI divergence to find the weak points of the current trend, and then we can utilize this information to spot the trend reversal at the right moment.

How Do You Detect Rsi Divergence During Forex Trading

Both Price Action (RSI indicator) and Price Action (Price Action) both did exactly the same thing at the beginning of the trend, making higher highs. This indicates that the trend has strength. When the trend is over, trend, price makes higher highs while the RSI indicator creates lower highs. This means that there are some things worth monitoring within this chart. This is the time to pay focus on the market since the indicator as well as the price action aren't in sync. It indicates that there is an RSI deviation. In this example this case, the RSI divergence indicates the bearish trend. Look at this chart to see what transpired following the RSI divergence. See, the RSI divergence is extremely accurate when it comes to detecting trend reversals. The real question is what can you do to spot the trend reverse? Let's take a look at 4 practical trade entry methods that can be combined with RSI Divergence to offer better entry signals. Take a look at top rated backtesting for more tips including best forex trading platform, trading platform cryptocurrency, backtester, best forex trading platform, backtesting, RSI divergence, stop loss, forex backtester, forex trading, crypto trading backtesting and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Triangle chart pattern is a pattern that can be utilized in two ways. A variation is the pattern known as the Ascending Triangle. It is a good choice as a reversal design during a downtrend. The second variation is the descending circle pattern which can be used as a reverse pattern in an upward trend market. Let's take an examination of the descending triangle pattern marked in the forex chart below. Similar to the previous instance, the market was on an upward trend , but the price began to fall. In the same way, RSI also signals the divergence. These signals indicate the weak points of this trend. Now, we can discern that the uptrend is slowing down. In the end, the price formed an upward triangle. This confirms the reverse. Now is the time to execute the trade short. Like the previous example we utilized the same breakout strategies to execute this trade too. Let's now move on to the third trade entry technique. This time , we'll combine trend structure and RSI diversity. Let's look at how to trade RSI diversgence in the event that the trend is changing. Follow the most popular forex backtesting for more examples including crypto backtesting, forex backtest software, backtester, software for automated trading, forex backtesting, RSI divergence, divergence trading forex, position sizing calculator, backtesting, software for automated trading and more.

Tip #2 – Combining RSI Divergence and the Head and Shoulders Pattern

RSI divergence aids forex traders to spot market reversals. Combining RSI diversification with other reversal indicators like the Head and Shoulders patterns could increase our chances of winning. That's great! Let's see how we can make sure we time our trades using RSI divergence as well as the Head and Shoulders pattern. Related to: How to Trade the Head and Shoulders pattern in Forex. A Reversal Trading Strategy. Prior to entering trades, it is important to have an enticing market. The markets that are trending are the best because we're looking for an inverse trend. Here is the chart. See the best crypto trading bot for more recommendations including crypto trading backtesting, backtesting strategies, divergence trading forex, bot for crypto trading, trading with divergence, cryptocurrency trading, cryptocurrency trading bot, backtesting strategies, automated forex trading, backtester and more.

Tip #3 – Combining RSI Diversity and Trend Architecture

The trend is our best friend. Trades should be made in the direction of the trend so long as the market is moving in the right direction. This is the way that professionals train. The trend will come to an end eventually however it will not last for a long time. Let's look at the structure of the trend, RSI Divergence , and how to spot those Reversals. We all know that the trend is making higher highs while the downtrend is making lower lows. This chart illustrates this point. On the left hand side of the chart you'll observe a downward trend. There are several of lows and lower highs. The next step is to examine the RSI Divergence (Red Line). The RSI creates high lows. Price action can create lows. What's the meaning of all this? Even though the market has created low RSI it's doing the opposite. This suggests that an ongoing downtrend might be losing momentum. See the most popular divergence trading for more tips including backtesting platform, crypto trading, online trading platform, forex backtesting software free, position sizing calculator, crypto backtesting, RSI divergence, divergence trading, RSI divergence, crypto trading backtester and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double top (or double bottom) is a pattern of reversal, which is created after a prolonged move or a trend. Double top is formed after the price has reached a threshold that cannot easily be broken. After that level is reached, the price may drop a bit, but then rebound back to test the earlier level. If it bounces once more off that point, you've got a DOUBLE OPTION. Check out the double top. It is evident in the double top that both tops were formed following a strong move. Notice how the second top is unable to break above the first top. This is a clear indication that a reversal is likely occur because it's warning that buyers that they are struggling to go higher. Similar principles apply to the double bottom, however, it's done in reverse. In here we use the technique of breakout entry. In this instance, we execute a sell trade after the price broke below the trigger line. The price fell below the trigger line, and we made a sale within a day. QUICK PROFIT. The double bottom is traded with the same methods. Below is a chart which will show you how to trade RSI diversgence using double top.

Remember that this isn't the only strategy to trade. There isn't any single trading strategy that is ideal. Also, all trading strategies experience losses. Even though we have a steady profit using this strategy for trading however, we also implement strict risk management and a fast method to reduce our losses. This allows us to minimize drawdowns, opening the possibility of huge upside potential.